TIDMTERN

RNS Number : 6261V

Tern PLC

11 August 2022

11 August 2022

Tern Plc

("Tern" or the "Company")

FundamentalVR Fund Raise

Further to the announcement dated 31 May 2022, Tern Plc

(AIM:TERN), the company focused on value creation from Internet of

Things ("IoT") technology businesses, is pleased to announce that

FVRVS Limited ("FundamentalVR"), has closed a second tranche of its

Series B fund raising round, securing an additional GBP5 million in

new investment (the "FundamentalVR Series B second tranche") from a

new institutional investor at the same valuation as the first

tranche, which was an uplift of 35% from the previous book

valuation of Tern's holding prior to the Series B fund raising.

Highlights

FundamentalVR has now raised a total of GBP13.2 million in

Series B funding ("FundamentalVR Series B"), from a new

institutional investor and its existing investors:

-- As previously announced on 31 May 2022, Tern converted the

GBP570,000 in loan notes and accrued interest it held in

FundamentalVR into equity in the business and has not invested

additional new money in this FundamentalVR Series B second

tranche;

-- The FundamentalVR Series B is intended to provide

FundamentalVR with funding to enable the business to focus on

accelerating its annual recurring revenue growth through the

significant pipeline of opportunities it has, together with

launching new data and analytical products, and establishing a

US-based artificial intelligence innovation centre;

-- Prior to the second tranche of the FundamentalVR Series B

fund raise Tern held 20.0% of FundamentalVR's equity. With the

completion of the GBP5 million FundamentalVR Series B second

tranche, Tern will hold 16.58% of FundamentalVR's equity (before

any dilution on exercise of any future FundamentalVR employee share

options), valued at GBP4.8 million at the valuation implied by the

FundamentalVR Series B funding round.

Commenting Al Sisto, CEO of Tern, said :

"We are delighted that FundamentalVR has secured the funding to

take advantage of the significant market traction it has gained in

the last eighteen months, particularly with growth in annual

recurring revenues, and the opportunities it is seeing.

"Given our focus on funding and assisting the earlier stages of

our company's development it is appropriate that we have not

committed further capital at the Series B stage. However, with the

funds raised we believe FundamentalVR has the potential to generate

significant future value for Tern and its shareholders and we are

delighted to continue to remain one of its largest

shareholders.

"FundamentalVR provides Tern and its shareholders with exposure

to the rapidly growing medical simulation market using low cost

open-system IoT devices. It is quickly building its annual

recurring revenues and the lifetime value of its contracts, and we

believe that the business will be an attractive target for a trade

buyer or for an IPO in due course. In the meantime, we look forward

to continuing to participate in the value it is creating."

FundamentalVR Fund Raise

Prior to the FundamentalVR Series B Tern had a holding of 26.9%

in FundamentalVR, plus a loan convertible into FundamentalVR equity

of GBP530,000 and accrued interest of GBP39,932. As at 31 December

2021, the date of Tern's last published book valuation, this

holding had an audited book value of GBP3.6 million. Including the

convertible loan notes , Tern has invested GBP2.9 million in

FundamentalVR since May 2018.

Following the two tranches of FundamentalVR Series B funding of

GBP13.2 million, Tern now has a holding of 16.58% in FundamentalVR

(before any dilution on exercise of any future FundamentalVR

employee share options) , with an unaudited book valuation of

GBP4.8 million, representing a 35% uplift on the 31 December 2021

book value of Tern's holding and an uplift of 62% over the amount

invested by Tern in FundamentalVR to date. The change in the

valuation and uplift of GBP6.3 million and 77%, respectively, as

disclosed in the announcement on 31 May 2022, has come to light as

a result of the calculations relating to the new holding following

the FundamentalVR Series B second tranche.

Further information on FundamentalVR

Since Tern's initial investment in FundamentalVR in May 2018 the

business has focussed on the commercialisation of its haptics

virtual reality simulation solutions, as a credible alternative to

in-person and on human learning. The adoption of FundamentalVR's

solutions accelerated as a result of the challenges of social

distancing and the reduction in elective surgeries as a result of

the Covid-19 pandemic and this trend is continuing.

Today, FundamentalVR is the world's first scalable medical

simulation platform to combine virtual reality and haptics through

data, artificial intelligence, and multimodal learning.

FundamentalVR's patented HapticVR(TM) technology mimics the

physical touch of surgical actions which allows users to experience

the sights, sounds, and physical sensations of real-life surgery.

Scalable and hardware agnostic, the platform immerses users in a

controlled training environment that lowers the surgical risk to

patients.

Deployed in over 30 countries, FundamentalVR's high-fidelity

simulations help life sciences, pharmaceutical, and med-device

companies deploy medical innovations in disciplines from

ophthalmology to robotics, gene therapy, and more. The growth

investment will enable further development of HapticVR(TM) , the

machine learning data insights product, and geographic expansion

throughout the US. FundamentalVR's multiuser platform enables

medical institutions, hospitals, and surgical educators, to scale

professionally accredited surgical training throughout their

organisations. Partnerships with hospital groups, including

flagship clients and investors Mayo Clinic and Sana Kliniken, will

help drive further growth. FundamentalVR has continued to trade

strongly in the past year, with significant new business wins and

long-term contracts secured.

Further information on FundamentalVR may be found at:

https://www.fundamentalvr.com

Enquiries

Tern Plc via IFC Advisory

Al Sisto (CEO)

Sarah Payne (CFO)

Allenby Capital Limited Tel: 0203 328 5656

(Nominated Adviser and Broker)

David Worlidge / Alex Brearley (Corporate

Finance)

Matt Butlin / Kelly Gardiner (Sales

and Corporate Broking)

IFC Advisory Tel: 0203 934 6630

(Financial PR and IR) tern@investor-focus.co.uk

Tim Metcalfe

Graham Herring

Florence Chandler

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKKBPABKDDFD

(END) Dow Jones Newswires

August 11, 2022 09:05 ET (13:05 GMT)

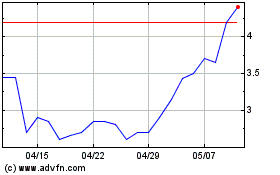

Tern (LSE:TERN)

過去 株価チャート

から 3 2024 まで 4 2024

Tern (LSE:TERN)

過去 株価チャート

から 4 2023 まで 4 2024