TIDMLEX

RNS Number : 8972A

Lexington Gold Limited

28 September 2022

28 September 2022

Lexington Gold Ltd

("Lexington Gold" or the "Company")

Interim Results for the half-year ended 30 June 2022

Lexington Gold (AIM: LEX), the gold exploration and development

company with projects in North and South Carolina, USA, is pleased

to announce its unaudited interim results for the six-month period

to 30 June 2022 ("H1 2022" or the "Period").

Highlights :

Corporate Summary

The first half of 2022 has been a productive period for the

Company, with encouraging exploration results announced for two of

the Company's gold projects in North and South Carolina, United

States, a region which has seen historical production and

multi-million-ounce mines. Lexington Gold remains focused on highly

prospective exploration and development work with the objective of

proving up a significant resources base.

The Company has increased its investment in exploration

activities whilst keeping overhead costs low. Exploration results

for the reporting period have been encouraging, with estimated

resources at one of the Company's four projects,

Jones-Keystone-Loflin, increasing by 27% since the period end to

approximately 83,000oz of contained gold.

Global macroeconomic uncertainty, especially in light of the

ongoing war in Ukraine and rising inflation, creates a climate that

has in the past often supported gold prices. Such an environment

also serves to highlight the benefits of operating in a stable

political and regulatory region, such as the USA.

Operational Highlights

Jones-Keystone-Loflin ("JKL") Project :

-- Drilling programme successfully completed on both the Loflin

and Jones-Keystone sides of the project thereby concluding the

Company's latest 5,000m reverse circulation ("RC") drill

programme

-- Assay results confirmed a significant new discovery which has been named Loflin South

-- Exceptional assay results obtained for the six RC drill holes at Jones-Keystone

Carolina Belle Project :

-- Very encouraging drill results received , predominantly from

two targets, McMaster and Martha Washington South, both showing

good intersections close to surface of approximately 1 g/t Au or

more

-- Results included 3m @ 3.68 g/t Au from 64m and 4m @ 1.8 g/t Au from 28m

-- Results of maiden drilling campaign being interpreted and

incorporated into a 3D model in order to facilitate the design of a

Phase II drilling programme to further target, define and expand on

intersected gold mineralisation at all three current targets

Post Period End :

-- Updated independent JORC Mineral Resource Estimate for the

Loflin side of the JKL Project of 82,700oz of contained gold as

announced on 8 August 2022. This is up 27% from the initial

estimate of September 2021 and includes over 9,000 gold ounces from

the newly discovered Loflin South

-- Potential for a significant further increase in the estimated

resources for Loflin and Loflin South via additional drilling,

subject to funding

-- Loflin project's 1m sample re-splits verified and further

defined high-grade shallow intercepts of up to approximately 10 g/t

Au

-- Jones-Keystone project's 1m sample re-splits verified and

further defined high-grade shallow intercepts of up to

approximately 7.5 g/t Au

-- Maiden JORC Mineral Resource Estimate for the Jones-Keystone

side of the JKL Project is currently being prepared following the

recent receipt of the 1m assay results for the Jones-Keystone

project

-- Appointment of WH Ireland Limited as Joint Broker

Financial Summary :

-- Net loss for H1 2022 from continuing operations was US$0.37m (H1 2021: US$0.47m)

-- Increased investment in exploration for H1 2022 of US$0.61m (H1 2021: US$0.43m)

-- Reduced operating expenses of US$0.36m (H1 2021: US$0.47m)

-- Total assets were US$4.78m as at the half-year end (31 December 2021: US$4.76m)

-- Cash position of US$0.37m as at the half-year end (31 December 2021: US$0.95m)

-- Total liabilities of US$0.44m as at the half-year end (31

December 2021: US$0.11m) of which US$0.41m relates to the unsecured

convertible loan of GBP335,000 principal amount which is repayable

by 30 April 2023 if not previously converted

For further information, please contact :

Lexington Gold Ltd www.lexingtongold.co.uk

Bernard Olivier (Chief Executive Officer) via Yellow Jersey

Edward Nealon (Chairman)

Mike Allardice (Group Company Secretary)

Strand Hanson Limited (Nominated Adviser) www.strandhanson.co.uk

Matthew Chandler / James Bellman / Abigail T: +44 207 409 3494

Wennington

WH Ireland Limited (Joint Broker) www.w hirelandplc.com

Katy Mitchell / Ben Good / Enzo Aliaj T: +44 207 220 1666

Peterhouse Capital Limited (Joint Broker) www.peterhousecap.com

Duncan Vasey / Lucy Williams (Broking) T: +44 207 469 0930

Eran Zucker (Corporate Finance)

Yellow Jersey PR Limited (Financial Public www.yellowjerseypr.com

Relations) T: +44 7948 758 681

Tom Randell / Annabelle Wills

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Note to Editors :

Lexington Gold (AIM: LEX) is focused on the exploration and

development of its four diverse gold projects, covering a combined

area of approximately 1,675 acres in North and South Carolina, USA.

The projects are situated in the highly prospective Carolina Super

Terrane ("CST"), which has seen significant historic gold

production and is host to a number of multi-million-ounce mines

operated by majors. It was also the site of the first US gold rush

in the early 1800s, before gold was discovered in California.

Further information is available on the Company's website:

www.lexingtongold.co.uk . Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

Chairman's Statement

Dear Fellow Shareholder,

I am pleased to present Lexington Gold's unaudited interim

results for the six-month period ended 30 June 2022 and to report

on the Company's ongoing activities to the date of this

statement.

It has been a period of substantial progress with the

publication of an updated and increased JORC resource estimate for

the Loflin deposit and the completion of our latest reverse

circulation ("RC") drilling campaign across both the Carolina Belle

and JKL projects. Lexington Gold remains focused on progressing

highly prospective exploration activities and the development and

proving up of significant gold resources. Exploration results

received in this reporting period serve to justify the Company's

acquisition of majority interests in its four gold exploration

projects in North and South Carolina in 2020, and the subsequent

investment in additional leased acreage last year, taking its total

project acreage in the Carolinas to approximately 1,675 acres.

Our exploration drilling during the period has led to the

identification of Loflin South as a separate resource, initially

estimated to contain over 9,000 gold ounces. The scope of the drill

programme has only enabled limited definition so far and the

deposit remains open in all directions. It is currently modelled as

two separate satellite deposits.

At Jones-Keystone-Loflin, we also commissioned and announced on

8 August 2022 an updated independent JORC (2012) Mineral Resource

Estimate for the Loflin deposit (including the 9,000 gold ounces

from Loflin South) comprising a total Inferred Resource of

2,596,000t @ 0.99 g/t Au for 82,700oz of contained gold, as at 31

July 2022. This represented a 27% increase in contained gold

achieved for the Loflin deposit when compared to the 65,000oz

estimated in September 2021.

There is potential for the mineralisation at Loflin to remain

open down-dip, to the north-east and along the plunge of the

syncline. There is also potential for significant further increases

in the resources for Loflin and Loflin South through additional

drilling. 3D Geological modelling and drilling to date has

delineated a NE-SW shallow plunging synclinal fold structure with

shallow gold mineralisation in the core of the structure.

A maiden JORC Mineral Resource Estimate for the Jones-Keystone

side of the JKL Project is currently being prepared by Pivot Mining

Consultants Pty Ltd following the recent receipt of the 1m assay

results for the Jones-Keystone project.

At Carolina Belle, during the reporting period, we received the

final assay results from our maiden drilling campaign, exceeding

our expectations for this reconnaissance programme. The results

were predominantly from two targets, McMaster and Martha Washington

South. Both targets returned excellent initial results with

multiple good intersections of 1 g/t Au or more found close to

surface, including 3m @ 3.68 g/t Au from 64m and 4m @ 1.8 g/t Au

from 28m. The drilling data and assay results now incorporated into

our database and models for Carolina Belle, are facilitating the

design of a Phase II drill campaign to further target, define and

expand the intersected gold mineralisation from the various targets

identified to date at the project.

Our investment in exploration activities during the period

increased by approximately 41% to US$612,000, while overhead costs

were reduced by approximately 22% to US$363,000 since the

comparable period in 2021.

In late April 2022, the Company obtained an unsecured GBP335,000

convertible loan which has ensured the uninterrupted implementation

of our exploration plans. The conversion price was set at 3.2p per

share being approximately a thirty per cent. premium to the then

prevailing market share price. The current market share price is

now in excess of the conversion price.

The current uncertain global macroeconomic environment, impacted

by the ongoing war in Ukraine and rising inflation, is one that in

the past has often supported gold prices and serves to highlight

the benefits of operating in a stable political and regulatory

region, such as the USA.

In August 2022, we were pleased to appoint WH Ireland Limited, a

leading broker to AIM quoted mining companies, as our joint

broker.

We look forward to obtaining a maiden resource estimate for the

Jones-Keystone deposit in the near term and thereafter to

continuing with our planned further exploration and development

work across our project portfolio.

Once again, I would like to thank our entire team for their

consistent delivery of results as we continue to execute our

exploration plans and develop our understanding of our exciting

assets in the Carolinas alongside our highly experienced local

joint venture partner, Uwharrie Resources Inc.

Mr Edward Nealon

Non-Executive Chairman

28 September 2022

Chief Executive's Operational and Financial Review

1 . Overview

H1 2022 has seen substantial progress, with the release of an

updated and increased JORC resource estimate for the Loflin deposit

and completion of our latest reverse circulation drilling campaign

across both the Carolina Belle and JKL projects.

We have learnt a substantial amount about the potential at our

four projects and been able to utilise our findings to refine our

plans. This ensures that we continue to make progress as quickly

and cost effectively as possible. We expect to be able to update

our total resources via a maiden resource estimate for

Jones-Keystone in the near term and to be able to commission

further updates as we implement additional exploration work.

During the period, we conducted the following principal

exploration activities on our portfolio projects:

At Carolina Belle, drilling identified and confirmed the

down-dip extension of the main historical ore-zone mined during the

historical third-party Iola and Uwarra gold mining operations with

a confirmed down-dip extension intersection of 4m @ 2.1 g/t Au from

64m to 68m in hole CRBC-24. Significant gold mineralisation was

intersected in the Footwall and Hangingwall of the main ore-zone of

the historical Iola and Uwarra gold mining operations with 11m @

1.01 g/t Au from 68m to 79m (combined Hangingwall, Footwall and

mined-out historical main ore-zone) in hole CRBC-22 including: (i)

a footwall intersection of 4m @ 1.62 g/t Au from 72m to 76m; (ii) a

Hangingwall intersection of 4m @ 0.7 g/t Au from 68m to 72m; and

(iii) a main historical ore-zone intersected between 72.2m and

73.2m. There was also a potential second gold mineralised zone

intersected approximately 25m above the main historical Iola and

Uwarra ore-zone with 4m @1.53 g/t Au from 48m to 52m in hole

CRBC-22 and four drill holes intersected the historical mine

workings of Iola and Uwarra. The McMaster target intersected

significant gold mineralisation including 3m @ 3.68 g/t Au from 64m

to 67m in hole CRBC-14; 4m @ 1.8g/t Au from 28m to 32m in hole

CRBC-15 as well as 4m @ 1.06 g/t Au from 20m to 24m in hole

CRBC-16. The newly discovered Martha Washington South target

intersected several intersections close to surface above 1g/t Au

including 8m @1.07 g/t Au from surface to 8m in hole CRBC-02 as

well as 4m @ 1.1g/t Au from 8m to 12m in hole CRBC-04.

At Loflin, a total of 18 drill holes for an aggregate of 1,695m

were drilled. Due to the significant sulphide mineralisation

intersected on the southern side and outside of the current known

Loflin resource ("Loflin South"), two additional RC drill holes

were drilled in the newly identified area. Detailed logging and

sampling of the 18 holes drilled on the combined Loflin South and

main Loflin deposit were completed with multiple intersections of

sulphide mineralisation and alteration zones of over 25m

identified. An additional 278 samples comprising 4 metre sample

composites as well as standards, blanks and duplicates, were

dispatched to American Assay Labs ("AAL") in Nevada for gold

assaying as well as whole-rock geochemistry analyses.

At Jones-Keystone, a total of 6 drill holes for an aggregate of

675m were drilled thereby concluding the latest 5,000m RC drilling

campaign. Initial logging identified multiple intersections of

alteration zones and sulphides mineralisation and the largest

combined intersection identified was over 50m. The primary aim of

the drilling on the Jones-Keystone side of JKL was to enable the

estimation of a maiden JORC compliant resource estimate. An

additional 190 samples comprising 4 metre sample composites as well

as standards, blanks and duplicates, were dispatched to AAL in

Nevada for gold assaying as well as whole-rock geochemistry

analyses.

Assay results also confirmed a significant new discovery at our

JKL Project, which has been named Loflin South, containing an

initial 9,000 ounce gold resource.

Selected assay result highlights include:

-- Hole LFRC-006: 36m @ 1.67 g/t Au and 1.89 g/t Ag from 20m to

56m including: 12m @ 3.27 g/t Au and 2.9 g/t Ag from 28m to 40m and

4m @ 5.63 g/t Au and 3.5 g/t Ag from 32m to 36m;

-- Hole LFRC-002: 20m @ 1.52 g/t Au and 1.67 g/t Ag from 16m to

36m including: 4m @ 3.01 g/t Au and 2.45 g/t Ag from 32m to 36m;

and

-- Hole LFRC-003: 8m @ 1.32 g/t Au from 80m to 88m including: 4m @ 1.45 g/t Au from 80m to 84m

Loflin South is located less than 250m south and south-east of

our maiden Loflin JORC resource estimate and there is potential for

significant expansion or enhancement of the current resource.

Successful drilling has extended the north-eastern boundary of

the known Loflin JORC resource with further selected assays

including:

-- Hole LFRC-008: 12m @ 1.26 g/t Au from 16m to 28m including:

4m @ 1.78 g/t Au from 20m to 24m; and

-- Silver (Ag) values of up to 3.5 g/t associated with gold

mineralisation and zones of high sulphide alteration.

Final assay results from the drill programme at Loflin included

shallow level infill drilling and testing of the North-Eastern,

South-Western and Southern boundaries and extensions, with the

following selected results:

-- Hole LFRC-018: 24m @ 1.07 g/t Au and 2.76 g/t Ag from 4m to

28m including: 4m @ 2.34 g/t Au and 6.41 g/t Ag from 24m to

28m;

-- Hole LFRC-009: 16m @ 1.27 g/t Au and 3.79 g/t Ag from 16m to

32m including: 8m @ 1.76 g/t Au and 6.48 g/t Ag from 20m to 28m;

and 4m @ 1.93 g/t Au and 6.11 g/t Ag from 24m to 28m;

-- Hole LFRC-010: 4m @ 0.58 g/t Au from 48m to 52m;

-- Hole LFRC-016: 4m @ 0.73 g/t Au from 4m to 8m;

-- Hole LFRC-011 intersected a cavity created by historic

underground workings between 10m and 20m below surface. A 2m

intersection immediately above the cavity returned grades of 0.42

g/t Au from 8m to 10m;

-- Drilling has extended the known north-eastern deposit

boundary and confirmed that the deposit remains open to the

north-east towards the direction of Jones-Keystone;

-- The Loflin deposit appears to pinch off in a South-Westerly

direction, but the drilling results also indicated that the deposit

opens towards the south and south-east and potentially links in

with the Loflin South deposit, with intersections including 36m

@1.67 g/t Au between 20m to 56m; and

-- Assay results returned values of up to 6.9 g/t Ag associated

with gold mineralisation and zones of high sulphide alteration.

At Jones-Keystone, exceptional assay results received for the

six RC drill holes included:

-- Hole JKRC-002: 52m @ 0.99 g/t Au from 72m to 124m including:

24m @ 1.37 g/t Au from 80m to 104m; 16m @ 1.7 g/t Au from 84m to

100m; and 4m @ 2.75 g/t Au from 92m to 96m;

-- Hole JKRC-004: 40m @ 1.27 g/t Au from 20m to 60m including:

28m @ 1.69 g/t Au from 28m to 56m; 16m @ 2.5 g/t Au from 28m to

44m; and 4m @ 4.56 g/t Au from 36m to 40m; and

-- Hole JKRC-003: 28m @ 1.37 g/t Au from 64m to 92m including:

8m @ 3.1 g/t Au from 64m to 72m and 4m @ 4.96 g/t Au from 64m to

68m.

The Jones-Keystone deposit remains open along strike and down

dip and the above results should support and facilitate the

commissioning of a Maiden JORC Resource Estimate for Jones-Keystone

in the near term.

2 . Financial Performance

-- Net loss for H1 2022 from continuing operations was US$0.37m (H1 2021: US$0.47m)

-- Total assets were US$4.8m as at the half-year end (31 December 2021: US$4.8m)

-- Cash position of US$0.37m as at the half-year end (31 December 2021: US$0.95m)

-- Total liabilities of US$0.44m as at the half-year end (31

December 2021: US$0.11m) of which US$0.41m relates to the unsecured

convertible loan of GBP335,000 principal amount which is repayable

by 30 April 2023 if not previously converted

3 . Dividend

The directors have not declared a dividend (2021: Nil).

4 . Corporate Activities

Funding

In late April 2022, an unsecured GBP335,000 convertible loan was

obtained from, inter alia, two significant shareholders and three

directors, including the Company's Chairman. This facility provides

additional working capital and financial flexibility as the Company

focuses on establishing a maiden JORC Resource estimate for

Jones-Keystone and the potential upgrading of the existing JORC

Resource estimate at Loflin. The conversion right for the lenders

concerned was set at 3.2p per share being approximately 30 per

cent. above the then prevailing market share price of 2.45p per

share.

5 . Post Period End

Post the reporting period end, at the combined Loflin and Loflin

South Project significant intercepts were recorded from 1m sample

re-splits including:

-- Hole LFRC-006: 34m @ 1.75 g/t Au from 21m to 55m including:

17m @ 2.9 g/t Au from 21m to 38m and 2m @ 10.09 g/t Au from 31m to

33m

-- Hole LFRC-009: 12m @ 1.95 g/t Au from 18m to 30m including:

6m @ 3.24 g/t Au from 22m to 28m and 2m @ 5.05 g/t Au from 22m to

24m

-- Hole LFRC-002: 23m @ 1.35 g/t Au from 16m to 39m including:

5m @ 3.09 g/t Au from 31m to 36m and 1m @ 6.13 g/t Au from 32m to

33m

-- Hole LFRC-018: 26m @ 1.04 g/t Au from 4m to 30m including: 3m @ 2.45 g/t Au from 25m to 28m

-- Hole LFRC-003: 6m @ 1.6 g/t Au from 82m to 88m including: 2m @ 2.93 g/t Au from 82m to 84m

-- Hole LFRC-008: 14m @ 1.2 g/t Au from 14m to 28m including: 4m @ 1.87 g/t Au from 19m to 23m

The 1m re-sampling of the 4m composites confirmed shallow,

high-grade intercepts of up to approximately 10g/t Au.

The updated independent JORC (2012) Mineral Resource Estimate

for the Loflin deposit (including 9,000oz at Loflin South),

reported as at 31 July 2022, was for a total Inferred Resource of

2,596,000t @ 0.99 g/t Au for 82,700oz of contained gold. This

represented a 27% increase in contained gold achieved for the

Loflin deposit versus the previous 65,000oz estimated in September

2021.

There is potential for mineralisation at Loflin to remain open

down-dip, to the north-east, along the plunge of the syncline. The

newly discovered Loflin South has had limited drilling and

definition and remains open in all directions and is currently

modelled as two separate satellite deposits. Accordingly, there is

potential for a significant further increase in resources for

Loflin and Loflin South through additional future drilling. 3D

Geological modelling and drilling has delineated a NE-SW shallow

plunging synclinal fold structure with shallow gold mineralisation

in the core of the structure.

Post the reporting period end, significant intercepts were

recorded from the Jones-Keystone 1m sample re-splits including:

-- Hole JKRC-002: 50m @ 1.09 g/t Au from 72m to 122m including:

o 27m @ 1.52 g/t Au from 72m to 99m

o 9m @ 2.71 g/t Au from 90m to 99m

o 1m @ 5.77 g/t Au from 93m to 94m

-- Hole JKRC-003: 28m @ 1.15 g/t Au from 66m to 94m including:

o 6m @ 2.67 g/t Au from 66m to 72m

o 1m @ 5.17 g/t Au from 67m to 68m

-- Hole JKRC-004: 31m @ 1.38 g/t Au from 28m to 59m including:

o 16m @ 2.15 g/t Au from 28m to 44m

o 1m @ 7.52 g/t Au from 32m to 33m

The 1m re-sampling of the 4m composites has confirmed shallow,

high-grade intercepts of up to approximately 7.5g/t Au.

A Maiden JORC Mineral Resource Estimate for the Jones-Keystone

side of the JKL Project is currently being prepared following the

recent receipt of the 1m assay results for the Jones-Keystone

deposit.

6 . Outlook

As a gold exploration and development company, the Directors

continue to believe that the group's gold projects in North and

South Carolina in the United States represent an excellent

opportunity to create long-term shareholder value through the

identi cation and exploration of gold deposits within the

well-mineralised but under explored Carolina Super Terrane.

Dr Bernard Olivier

Chief Executive Officer

28 September 2022

Interim Financial Statements

Lexington Gold Ltd

Condensed Consolidated Statement of Profit and Loss and Other

Comprehensive Income

For the Half-Year ended 30 June 2022

(Unaudited)

Unaudited Unaudited

Notes Six months Six months

ended 30 ended 30

June 2022 June 2021

$'000 $'000

----------- -----------

CONTINUING OPERATIONS

Operating expenses 3 (363) (467)

Fair value gain on derivative liability 6 -

Finance cost (10) -

Loss before income tax (367) (467)

Income tax credit/(charge) - -

----------- -----------

Loss for the period (367) (467)

----------- -----------

Other comprehensive income

Loss for the period (367) (467)

Items that may be reclassified to profit

or loss:

Foreign currency reserve movement - -

----------- -----------

Total comprehensive loss for the period (367) (467)

----------- -----------

Loss per share attributable to the

owners of the parent

Basic and diluted loss per share from

continuing operations (cents per share) 4 (0.14) (0.18)

The accompanying notes form part of these financial

statements.

Lexington Gold Ltd

Consolidated Statement of Financial Position

As at 30 June 2022 (Unaudited)

Unaudited Audited

Notes 30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Non-current assets

Exploration and evaluation assets 5 4,376 3,764

---------- ------------

Total non-current assets 4,376 3,764

---------- ------------

Current assets

Trade and other receivables 27 45

Cash and cash equivalents 373 953

---------- ------------

Total current assets 400 998

---------- ------------

Total assets 4,776 4,762

---------- ------------

Equity

Share capital 787 787

Share premium 59,096 59,096

Share option reserve 603 555

Foreign currency translation reserve (2) (2)

Accumulated loss (57,117) (56,750)

---------- ------------

Total equity attributable to equity

owners of the parent 3,367 3,686

Non-controlling interest 970 970

---------- ------------

Total equity 4,337 4,656

---------- ------------

Current liabilities

Trade and other payables 26 106

Borrowings 6 372 -

Derivative liability 7 41 -

---------- ------------

Total current liabilities 439 106

---------- ------------

Total equity and liabilities 4,776 4,762

---------- ------------

The accompanying notes form part of these financial

statements.

Lexington Gold Ltd

Consolidated Statement of Changes in Equity

For the Half-Year Ended 30 June 2022

(Unaudited)

Total

Foreign equity

Issued Share currency Accumu- attribu-table

share Share option trans-lation lated to Non-controlling Total

capital premium reserve reserve loss share-holders interest equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Six months

ended

30 June 2022

(unaudited)

At start of

period 787 59,096 555 (2) (56,750) 3,686 970 4,656

Total

comprehensive

loss for the

period - - - - (367) (367) - (367)

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Loss for the

period - - - - (367) (367) - (367)

Foreign

exchange gain

on translation - - - - - - - -

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Share options - - 48 - - 48 - 48

At end of

period 787 59,096 603 (2) (57,117) 3,367 970 4,337

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Six months

ended

30 June 2021

(unaudited)

At start of

period 787 59,096 234 (3) (55,729) 4,385 971 5,356

Total

comprehensive

loss for the

period - - - - (467) (467) - (467)

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Loss for the

period - - - - (467) (467) - (467)

Foreign

exchange gain

on translation - - - - - - - -

--------- --------- --------- ------------- --------- -------------- ---------------- --------

Share issue

cost - - 108 - - 108 - 108

--------- --------- --------- ------------- --------- -------------- ---------------- --------

At end of

period 787 59,096 342 (3) (56,196) 4,026 971 4,997

--------- --------- --------- ------------- --------- -------------- ---------------- --------

The accompanying notes form part of these financial

statements.

Lexington Gold Ltd

Consolidated Statement of Cash Flows

For the Half-Year Ended 30 June 2022

(Unaudited)

Unaudited Unaudited

Notes Six months Six months

ended 30 ended 30

June 2022 June 2021

$'000 $'000

----------- -----------

Cash flows used in operating activities

Cash absorbed by operations 8 (365) (399)

Net cash used in operating activities (365) (399)

----------- -----------

Cash flows used in investing activities

Payments for exploration (612) (434)

Net cash used in/by investing activities (612) (434)

----------- -----------

Cash flows from financing activities

Proceeds from borrowings 416 -

Net cash generated from financing activities 416 -

----------- -----------

Net decrease in cash and cash equivalents (561) (833)

----------- -----------

Movement in cash and cash equivalents

Exchange (losses)/gains (19) 3

At the beginning of the period 953 2,895

Decrease (561) (833)

----------- -----------

At the end of the period 373 2,065

----------- -----------

The accompanying notes form part of these financial

statements.

Lexington Gold Ltd

Notes to the interim financial information

For the Half-Year Ended 30 June 2022

(Unaudited)

1 . Basis of preparation

The unaudited interim financial information set out above, which

incorporates the financial information of the Company and its

subsidiary undertakings (the "Group"), has been prepared using the

historical cost convention and in accordance with International

Financial Reporting Standards ("IFRS") and with those parts of the

Bermuda Companies Act, 1981 applicable to companies reporting under

IFRS.

These interim results for the six months ended 30 June 2022 are

unaudited and do not constitute statutory accounts as defined in

section 87A of the Bermuda Companies Act, 1981.The financial

statements for the year ended 31 December 2021 have been delivered

to the Registrar of Companies and the auditors' report on those

financial statements was unqualified but contained an emphasis of

matter paragraph on going concern.

2 . Going concern

For the period ended 30 June 2022, the Group recorded a loss of

US$0.37m and had net cash outflows from operating activities of

US$0.37m. An operating loss is expected in the year subsequent to

the date of these financial statements. The ability of the entity

to continue as a going concern is dependent on the Group generating

positive operating cash flows and/or securing additional funding

through the raising of debt and/or equity to fund its projects.

These conditions indicate a material uncertainty that may cast a

significant doubt about the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

The financial statements have been prepared on the basis that

the entity is a going concern, which contemplates the continuity of

normal business activity, realisation of assets and settlement of

liabilities in the normal course of business for the following

reasons:

-- The Company raised additional funding by way of a convertible

loan of GBP335,000 in late April 2022;

-- The Directors are confident that they will be able to raise

additional funds to satisfy its immediate cash requirements and

have successfully raised financing in the past; and

-- The Directors have the ability to reduce expenditure in order to preserve cash if required.

Should the entity not be able to continue as a going concern, it

may be required to realise its assets and discharge its liabilities

other than in the ordinary course of business, and at amounts that

differ from those stated in the financial statements. The financial

statements do not include any adjustments relating to the

recoverability and classification of recorded asset amounts or

liabilities that might be necessary should the entity not continue

as a going concern.

3 . Operating (expenses)/income

Unaudited Unaudited

Six months Six months

ended 30 ended 30

June 2022 June 2021

$'000 $'000

----------- -----------

Directors' emoluments and fees (98) (98)

Net foreign exchange (loss)/gain (15) 3

Office expenses (27) (18)

Professional and other services (164) (246)

Share option expense (48) (108)

Other expenses (11) -

----------- -----------

Total operating expenses (363) (467)

----------- -----------

4 . Basic and diluted loss per share

The calculation of basic and diluted loss per share for the six

months ended 30 June 2022 was based on the loss attributable to

common shareholders from continuing operations of US$367,000 (H1

2021: US$467,000) and a weighted average number of common shares

outstanding of 261,478,810 (H1 2021: 261,478,810).

5 . Exploration and evaluation assets

Unaudited Audited

30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Balance at beginning of period 3,764 2,499

Additions 612 1,265

4,376 3,764

---------- ------------

The amount above relates to exploration and development

activities in respect of the Group's 51% investment in four diverse

gold projects, covering a combined area of over 1,675 acres in

North and South Carolina, USA.

The projects are situated in the highly prospective Carolina

Super Terrane ("CST"), which has seen significant historic gold

production and is host to a number of multi-million-ounce mines

operated by majors. It was also the site of the first US gold rush

in the early 1800s, before gold was discovered in California.

In order for the Company to retain its 51% membership interests

in the four projects, it has to make certain Minimum Funding

Contributions in respect of each of the projects in each of the

four years and throughout the four-year period following its

re-admission to AIM in November 2020, in an aggregate amount of

AU$5 million (the "Minimum Funding Contributions"). The Minimum

Funding Contributions are further detailed in note 9.

In the event that the Minimum Funding Contributions are not

satisfied by the Company, Uwharrie Resources Inc., the Company's

joint venture partner, has the option to acquire the Company's 51%

interest in the relevant project for a nominal sum of AU$1.

The directors have assessed the value of the exploration and

evaluation asset having considered any indicators of impairment,

and in their opinion, based on a review of future expected

availability of funds to develop the projects and the intention to

continue exploration and evaluation, no impairment is

necessary.

6 . Borrowings

Unaudited Audited

30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Interest bearing borrowings 372 -

372 -

---------- ------------

As announced on 25 April 2022, the Company has entered into

unsecured convertible loan agreements with respect to borrowing, in

aggregate, GBP335,000 principal amount (the "Convertible Loan"),

predominantly with certain long term significant shareholders and

Company Directors (together, the "Lenders"). The Convertible Loan

is unsecured and repayable with accrued interest on 30 April

2023.

Interest accrues at 6 per cent. per annum to maturity and is

payable in full in new common shares ("Shares") if the Convertible

Loan is converted. The interest rate increases to 10 per cent. per

annum in the event of any unremedied default as set out in the

underlying agreements.

The conversion price is the lower of: a) 3.2 pence per Share; or

b) 0.9 times the price at which the Company issues any Shares for

cash prior to the conversion date (a "Qualifying Financing"); or c)

0.9 times the price offered by any person and their affiliates (an

"Offeror") to buy Shares with the objective of seeking to acquire

more than a 30% relevant interest in the Company's issued Shares (a

"General Offer").Automatic conversion occurs in the event of a

Qualifying Financing. In the event of a General Offer, a Lender can

elect to convert their Convertible Loan and accrued interest into

Shares at the Conversion Price.

7 . Derivative liability

Unaudited Audited

30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Derivative liability from option to

redeem borrowings for shares 41 -

---------- ------------

41 -

---------- ------------

It was determined that the redemption option (refer to Note 6)

upon the occurrence of a redemption event (e.g. a Qualifying

Financing, etc.) should be bifurcated and accounted for

separately.

The embedded derivative liability represents the combined fair

value of the right of borrowers to receive Shares upon conversion.

The embedded derivative liability is adjusted to reflect fair value

at each period end with changes in fair value recorded in profit

and loss.

8 . Cash (absorbed)/generated by operations

Unaudited Unaudited

Six months Six months

ended 30 ended 30

June 2022 June 2021

$'000 $'000

----------- -----------

Loss before income tax (367) (467)

Adjusted for:

* Fair value gain on derivative liability (6) -

* Finance cost 10 -

* Share options expense 48 108

* Net foreign exchange difference 10 (3)

Cash from operations before working

capital changes (305) (362)

Working capital changes:

Trade and other receivables 18 30

Trade and other payables (78) (67)

----------- -----------

Cash (absorbed)/generated by operations

before interest and tax (365) (399)

----------- -----------

9 . Commitments and contingencies

Pursuant to the terms of its acquisition of Global Asset

Resources Limited ("GAR") in November 2020, Lexington Gold is

required to pay conditional deferred consideration, of, in

aggregate, AU$1.5m (being the Tranche 1 Deferred Consideration if

the Tranche 1 Performance Milestone detailed below is met) and the

sum of, in aggregate, AU$3.0m (being the Tranche 2 Deferred

Consideration if the Tranche 2 Performance Milestone detailed below

is met) to the Sellers and Uwharrie Resources Inc. ("URI"), in cash

or New Common Shares at the Company's sole discretion, subject to

the achievement by the Group of the Tranche 1 Performance Milestone

and Tranche 2 Performance Milestone or the occurrence of certain

Vesting Events within five years of completion of the Company's

acquisition of Global Asset Resources Ltd ("GAR"). No provision has

been made for the payment of the deferred consideration as the

Tranche 1 Performance Milestone, Tranche 2 Performance Milestone

and Vesting Events have not occurred.

The Tranche 1 Performance Milestone comprises confirmation by an

independent geologist and announcement by the Company of JORC 2012

compliant resources in respect of any one of the GAR Projects

(including any Additional Projects) that are not Excluded Projects

of at least:

a) 0.8 million ounces of gold at a grade of more than 1 g/t; or

b) 0.6 million ounces of gold at a grade of more than 2.5 g/t; or

c) 0.4 million ounces of gold at a grade of 5 g/t or more.

The Tranche 1 Deferred Consideration, payable within 21 business

days of the achievement of the Tranche 1 Performance Milestone or

occurrence of certain Vesting Events, comprises AU$1,299,000,

payable in cash or New Common Shares at the Relevant Price (in

whole or in part) at the Company's sole discretion, to the Sellers;

and AU$201,000, payable in cash or New Common Shares at the

Relevant Price (in whole or in part) at the Company's sole

discretion, to URI.

The Tranche 2 Performance Milestone comprises the commissioning

from an independent geologist, completion and announcement by the

Company, in accordance with the AIM Rules, of a pre-feasibility

study in respect of any one of the GAR Projects (including any

Additional Projects) that are not Excluded Projects confirming a

pre-tax NPV of more than US$50m at a discount rate of at least 8

per cent.

The Tranche 2 Deferred Consideration, payable within 21 business

days of the achievement of the Tranche 2 Performance Milestone or

occurrence of certain Vesting Events, comprises AU$2,598,000,

payable in cash or New Common Shares at the Relevant Price (in

whole or in part) at the Company's sole discretion, to the Sellers;

and AU$402,000, payable in cash or New Common Shares at the

Relevant Price (in whole or in part) at the Company's sole

discretion, to URI. If the Tranche 1 Deferred Consideration has not

previously been paid at the time of achievement of the Tranche 2

Performance Milestone, the Tranche 1 Deferred Consideration will

also become payable in cash or New Common Shares (at the Company's

sole discretion) at such time.

The Joint Venture Implementation Deed between GAR, URI and

Carolina Gold Resources also sets out certain Minimum Funding

Contributions in respect of each of the GAR Projects to be provided

by the Company in each of the four years and throughout the

four-year period following Admission in order to retain its 51 per

cent. interest in the Projects which are summarised below. In the

event that the Minimum Funding Contributions are not satisfied by

Lexington Gold (on both an annual and overall basis), URI has the

option to acquire the Company's 51 per cent. membership interest

(via GAR Holdings) in the relevant Project SPV for a nominal sum of

AU$1. The Company similarly has the option to sell its 51 per cent.

membership interest in any of the GAR Projects to URI at any time

during the four-year period following Admission for AU$1 should the

Board determine that the Company no longer wishes to proceed with

one or more of the GAR Projects.

Minimum Funding Contributions for the Company to retain its 51

per cent . membership interests

AU$

Minimum Minimum Minimum Minimum Minimum

Project Total Year Year Year Year

1 2 3 4

JKL 1,500,000 250,000 150,000 150,000 150,000

Carolina Belle 1,500,000 250,000 100,000 100,000 100,000

Jennings-Pioneer 1,000,000 100,000 100,000 100,000 100,000

Argo 1,000,000 100,000 100,000 100,000 100,000

---------- -------- -------- -------- --------

5,000,000 700,000 450,000 450,000 450,000

---------- -------- -------- -------- --------

At the end of the initial four-year period following Admission

and satisfaction of the Minimum Funding Contributions for a

Project, if URI elects not to fund its proportionate share of

future costs or fails to make an election then, in accordance with

the terms of the Joint Venture Implementation Deed, the Company

will potentially be able to increase its interest in each of the

Project SPVs to 80 per cent. by meeting certain further funding

commitments in years 5 and 6 (on both an annual and overall basis)

following Admission (the "Extended Period").

Extended Period funding contributions from the Company to

acquire an additional 29 per cent . membership interest and

increase its total interest to 80 per cent.

Minimum Minimum Minimum

Project Total Year Year

5 6

JKL 2,500,000 150,000 150,000

Carolina Belle 2,500,000 100,000 100,000

Jennings-Pioneer 1,500,000 100,000 100,000

Argo 1,500,000 100,000 100,000

---------- -------- --------

8,000,000 450,000 450,000

---------- -------- --------

If the Company does not meet the Extended Period funding

contributions in relation to a particular Project, it will retain

its 51 per cent. initial interest in such Project SPV.

In the event that the Company increases its interest in any of

the Project SPVs to 80 per cent. and URI elects not to fund its

proportionate share of future costs in respect of its then 20 per

cent. residual interest in the GAR Project concerned or fails to

make an election, the Company is able to increase its interest in

the relevant Project to 100 per cent. by agreeing to pay for the

relevant Project, a Net Smelter Royalty to URI of 0.5 per cent. for

future production up to 50,000 oz gold equivalent, 2.0 per cent.

for future production from 50,000 to 400,000 oz gold equivalent and

1.0 per cent. for future production in excess of 400,000 oz gold

equivalent.

10 . Related parties

Identity of related parties

The Group has a related party relationship with its subsidiaries

and key management personnel.

Remuneration of key management personnel

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities of the entity, directly or indirectly, including any

director (whether executive or otherwise) of the Group. Details of

the nature and amount of each element of the remuneration of each

director of the Group during the period are shown in the table

below:

Six months ended 30 June

2022

Share

based

Directors' Executive payments

fees fees (1) (2) Total

----------- ---------- ---------- --------

US$ US$ US$ US$

Edward Nealon 11,250 6,750 6,431 24,431

Bernard Olivier 11,250 39,000 10,182 60,432

Melissa Sturgess 11,250 - 6,431 17,681

Rhoderick Grivas 11,250 6,750 6,431 24,431

----------- ---------- ---------- --------

45,000 52,500 29,475 126,975

----------- ---------- ---------- --------

Six months ended 30 June

2021

Share

based

Directors' Executive payments

fees fees (1) (2) Total

----------- ---------- ---------- --------

US$ US$ US$ US$

Edward Nealon 11,250 6,750 14,415 32,415

Bernard Olivier 11,250 39,000 22,823 73,073

Melissa Sturgess 11,250 - 14,415 25,665

Rhoderick Grivas 11,250 6,750 14,415 32,415

----------- ---------- ---------- --------

45,000 52,500 66,068 163,568

----------- ---------- ---------- --------

(1) For duties as executive director and consulting.

(2) In accordance with the requirements of IFRS 2 Share-based

payments, the estimated fair value for the share options granted

was calculated using a Black Scholes option pricing model. None of

the share options have been exercised as they are out of the

money.

Borrowings and advances from directors and shareholders

Unaudited Audited

30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Ed Nealon 63 -

Bernard Olivier 4 -

Melissa Sturgess 13 -

Rhoderick Grivas 32 -

Astor Management AG 61 -

Aero Services (IOM) Limited 123 -

Pure Ice Ltd 123 -

419 -

---------- ------------

Current directors of the holding company and their close family

members, as at the date of these financial statements, control

4.25% (31 December 2021: 4.25%) of the voting shares of Lexington

Gold.

11 . Fair value

Carrying amount versus fair value

The following table compares the carrying amounts and fair

values of the Group's financial assets and financial liabilities as

at 30 June 2022.

The Group considers that the carrying amount of the following

financial assets and financial liabilities are a reasonable

approximation of their fair value:

-- Trade and other receivables

-- Trade and other payables

-- Cash and cash equivalents

As at 30 June 2022 As at 31 December

2021

Carrying Fair value Carrying Fair value

amount amount

--------- ----------- --------- -----------

$'000 $'000 $'000 $'000

Financial liabilities

Borrowings 372 372 - -

Derivative liability 41 41 - -

--------- ----------- --------- -----------

Total 413 413 - -

--------- ----------- --------- -----------

Fair value hierarchy

The level in the fair value hierarchy within which the financial

asset or financial liability is categorised is based on the lowest

level input that is significant to the fair value measurement.

Financial assets and financial liabilities are classified in

their entirety into only one of the three levels. The fair value

hierarchy has the following levels:

-- Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities

-- Level 2 - inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from

prices)

-- Level 3 - inputs for the asset or liability that are not

based on observable market data (unobservable inputs).

(in $'000) As at Level 1 Level 2 Level 3

30 June

2022

Financial liabilities

Derivative liability 41 - - 41

------------ -------- -------- --------

As at Level 1 Level 2 Level 3

31 December

2021

Financial liabilities

Derivative liability - - - -

------------ -------- -------- --------

Reconciliation: Level 3 recurring fair value measurements

Unaudited Audited

30

June 31 December

2022 2021

$'000 $'000

---------- ------------

Derivative liability

Opening balance - -

On initial recognition of borrowings 47 -

Fair value adjustment recognised during (6) -

the period

41 -

---------- ------------

Transfers during the period

During the 6-month period to 30 June 2022:

-- There were no transfers between Level 1 and Level 2 fair value measurements

-- There were no transfers into or out of Level 3 fair value measurements

Valuation techniques

Derivative liabilities

A Monte-Carlo simulation option pricing model was used to

estimate the fair value of the conversion options embedded in

borrowings. The model requires the development and use of

assumptions. These assumptions include estimated volatility of the

value of common shares and an appropriate risk-free interest

rate.

12 . Subsequent events

On 11 July 2022, the Company announced the receipt of the

results for 1m re-splits taken from the RC drill hole 4m composite

samples across its combined Loflin and Loflin South Project. All of

the holes concerned were originally sampled as 4m composites. All

composites which returned a gold grade of more than 200ppb Au were

subsequently re-sampled in the field and assayed on a 1m basis. The

1m re-sampling confirmed shallow, high-grade intercepts of up to

approximately 10g/t Au and the results were incorporated into the

Company's geological model.

On 8 August 2022, the Company announced an updated independent

JORC (2012) Mineral Resource Estimate for the Loflin side of the

JKL Project prepared by Pivot Mining Consultants Pty Ltd of

2,596,000t @ 0.99 g/t Au for 82,700oz of contained gold. This

represented a 27% increase in contained gold versus the previous

estimate in September 2021.

On 15 August 2022, the Company announced the appointment of WH

Ireland Limited as its Joint Broker.

On 26 September 2022, the Company announced the receipt of the

results for 1m re-splits taken from the RC drill hole 4m composite

samples at its Jones-Keystone deposit that forms part of the JKL

Project. The 1m re-sampling confirmed shallow, high-grade

intercepts of up to approximately 7.5g/t Au and the results are

currently being incorporated into the Company's geological

model.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRATIDFIF

(END) Dow Jones Newswires

September 28, 2022 02:00 ET (06:00 GMT)

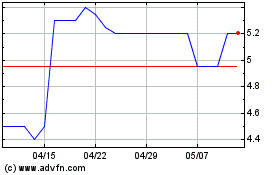

Lexington Gold (LSE:LEX)

過去 株価チャート

から 3 2024 まで 4 2024

Lexington Gold (LSE:LEX)

過去 株価チャート

から 4 2023 まで 4 2024