IMC Exploration Group Plc Approval and Publication of Prospectus

2023年10月2日 - 3:00PM

RNSを含む英国規制内ニュース (英語)

TIDMIMC

THE DIRECTORS OF IMC EXPLORATION GROUP PLC CONSIDER THIS ANNOUNCEMENT TO CONTAIN

INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO. 596/2014

OF THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16 APRIL 2014 ON MARKET ABUSE AS

IT FORMS PART OF RETAINED EU LAW AS DEFINED IN THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018 (THE "MARKET ABUSE REGULATION"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT THE INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

IMC EXPLORATION GROUP PLC

("IMC" or the "Company")

APPROVAL AND PUBLICATION OF PROSPECTUS

DUBLIN: 2 October 2023 - IMC Exploration Group plc (LSE: IMC) is pleased to

announce that a prospectus dated 29 September 2023 (the "Prospectus") has been

approved by the UK Financial Conduct Authority (FCA) and published by the

Company.

A copy of the Prospectus is available on the Company's website

https://www.imcexploration.com . In addition, a copy is being submitted to the

National Storage Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Unless otherwise defined herein, capitalised terms used in this announcement

shall have the same meanings as those defined in the Prospectus.

The Prospectus has been produced in connection with the proposed acquisition by

the Company of the entire issued share capital of MVI Ireland s.r.o. ("MVI")

from Mineral Ventures Invest spol. s r.o. (the "Seller"), (the "Acquisition").

MVI holds the entire issued share capital in Assat, LLC ("Assat"), which holds

the Karaberd Operating Licence in respect of the Karaberd gold mine, located in

northern Armenia, together with ore crushing facilities located between Vanadzor

and Karaberd.

The Acquisition is a reverse takeover pursuant to the FCA Listing Rules, meaning

that it is subject to and conditional upon approval of the Company's

shareholders. Furthermore, the Irish Takeover Panel has granted a waiver of the

requirement arising for the Seller to make an offer for the entire issued share

capital of the Company under Rule 9 of the Irish Takeover Rules which would

arise on the Seller acquiring control of the Company on completion of the

Acquisition, subject to the approving resolution to be proposed at the EGM being

duly passed.

Accordingly, a Notice of Extraordinary General Meeting to take place on 26

October 2023 will shortly be despatched to shareholders. The EGM will consider,

and, if thought fit, pass the Resolutions approving, inter alia, the Acquisition

and a waiver of Rule 9 of the Irish Takeover Rules.

Subject to the Resolutions being passed by the EGM, Completion of the

Acquisition pursuant to the Framework Agreement is expected to occur on 2

November 2023. Subject to the Acquisition becoming effective, 349,399,716 New

Ordinary Shares will immediately be issued to the Seller. Furthermore, the

Company has agreed to issue 9,406,856 New Ordinary Shares in consideration for

professional services rendered by members of the existing Board and others (the

"Fee Shares"). As at the Latest Practicable Date, the Company has in issue

326,290,907 Ordinary Shares of ?0.001 each.

The Prospectus relates to the application for 358,806,572 New Ordinary Shares

(the aggregate of the New Ordinary Shares to be issued to the Seller on

Completion plus the Fee Shares) to be admitted to the standard segment of the

FCA Official List and to trading on the London Stock Exchange's main market for

listed securities. Admission of the New Ordinary Shares and readmission of the

Existing Ordinary Shares to the standard segment of the FCA Official List and to

trading on the LSE's main market for listed securities is expected to occur, and

dealings are expected to commence on the London Stock Exchange, at 8:00 a.m. on

6 November 2023.

DEFERRED CONSIDERATION SHARES

Further Ordinary Shares may be allotted and issued by the Company to the Seller

as deferred consideration for the Acquisition on the achievement of certain

milestones (the First Additional Consideration Event and the Second Additional

Consideration Event) specified in the Framework Agreement, or upon conversion of

the Preference Shares (see below).

Under the Framework Agreement, the First Additional Consideration Event shall

occur once IMC has reached a total market capitalisation of £100 million and

substantially retained that value for 90 days, in which case a further

68,509,748 Ordinary Shares shall be issued and allotted to the Seller; and the

Second Additional Consideration Event shall occur once IMC has reached a total

market capitalisation of £200 million and substantially retained that value for

90 days, in which case a further 68,509,748 Ordinary Shares shall be issued and

allotted to the Seller.

The Framework Agreement provides that the number of Ordinary Shares to be

allotted to the Seller in relation to the First Additional Consideration Event

and the Second Additional Consideration Event may be adjusted arising from an

increase in the Market Capitalisation of IMC that can be fully attributed to

either (i) IMC's business activities commenced prior to the Closing Date and

such events occurring between the Closing Date and the First Adjustment Date and

between the First Adjustment Date and the Second Adjustment Date, as the case

may be, in particular but not limited to ore body discoveries on IMC's Irish

exploration licence territories which IMC holds before the Closing Date or (ii)

is based on other equity measures, such as e.g. issuance of shares to

shareholders other than MVI (or any of its controlled entities). Certain defined

terms used in this paragraph have the meanings given to them in the Framework

Agreement.

PREFERENCE SHARES

It is proposed, subject to the Resolutions being passed at the EGM, that the

share capital of the Company be amended by the creation of a new class of

preference share of ?1.00 each in the capital of the Company, to facilitate the

subscription by the Seller for 1,500,000 Preference Shares on a phased basis of

?250,000 per month for the first six months after completion of the Acquisition

for an aggregate subscription amount of ?1,500,000 pursuant to the Subscription

Agreement, which was entered into on 29 September 2023. The purpose of the

proposed Share Subscription is to provide the Company with sufficient working

capital for the next 12 months.

The Preference Shares, if allotted and issued, will entitle the holder thereof

to a preferential return of capital, in priority to any other class of shares in

the capital of the Company, on a return of capital or in the event of a change

of control in the Company. If allotted and issued, the Preference Shares shall

not entitle the holder thereof to vote or to a dividend. The Preference Shares

may be converted into Ordinary Shares at the option of either the Seller or IMC.

The ?1,500,000 in Preference Shares, if all converted into Ordinary Shares,

would result in a maximum of a further 21,092,903 Ordinary Shares being allotted

to the Seller.

CAUTIONARY NOTICES

This announcement is an advertisement for the purposes of the Prospectus

Regulation Rules of the Financial Conduct Authority (the "FCA") and not a

prospectus. Interested parties are advised to read the Prospectus in its

entirety.

This announcement is for information purposes only and is not intended to and

does not constitute, or form part of, any offer or invitation to purchase,

subscribe for or otherwise acquire or dispose of, or any solicitation to

purchase or subscribe for or otherwise acquire or dispose of, any securities in

any jurisdiction. The information in this announcement does not purport to be

full or complete and may be subject to change without notice.

This announcement is not for release, publication or distribution, in whole or

in part, directly or indirectly, in, into or from any jurisdiction where to do

so would constitute a violation of the relevant securities laws of such

jurisdiction. This announcement does not purport to give legal, tax or financial

advice.

Except to the extent required by applicable laws and regulations, including the

Listing Rules of the FCA, each of IMC and Keith Bayley Rogers & Co. Limited and

their respective affiliates expressly disclaim any obligation or undertaking to

update, review or revise any forward-looking statement contained in this

announcement whether as a result of new information, future developments or

otherwise.

Keith Bayley Rogers & Co. Limited, which is authorised and regulated by the FCA,

is acting for IMC and for no one else in connection with this announcement and

the matters referred to herein, and accordingly will not be responsible to any

person other than IMC for providing the protections afforded to customers of

Keith Bayley Rogers & Co. Limited, or for providing advice to any other person

in relation to the announcement or the matters referred to herein.

The directors of the Company accept responsibility for the contents of this

announcement.

Enquiries:

IMC Exploration Group plc

Eamon O'Brien

+353 87 6183024

Keith Bayley Rogers & Co. Limited (financial adviser to IMC Exploration Group

plc)

Brinsley Holman

brinsley.holman@kbrl.co.uk

+44 (0)7776 302 228

Stephen Clayson

stephen.clayson@kbrl.co.uk

+44 (0)7771 871 847

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/imc-exploration-group-plc/r/approval-and-publication-of-prospectus,c3845705

END

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

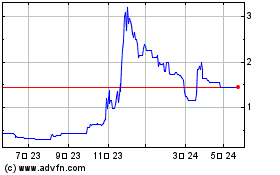

Imc Exploration (LSE:IMC)

過去 株価チャート

から 10 2024 まで 11 2024

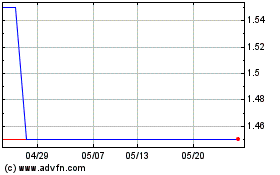

Imc Exploration (LSE:IMC)

過去 株価チャート

から 11 2023 まで 11 2024