TIDMASTO

RNS Number : 0047N

AssetCo PLC

20 September 2023

20 September 2023

LEI: 213800LFMHKVNTZ7GV45

AssetCo plc

("AssetCo" or the "Company")

Sale of Interest in Rize ETF Limited ("Rize") and update on

Parmenion

Sale of Interest in Rize ETF Limited

AssetCo is pleased to announce the disposal today of its 70%

equity interest in Rize, a thematic ETF specialist, to ARK Invest

LLC ("ARK"), a successful and established player in the ETF market

based in the US. The sale agreement delivers consideration to

AssetCo of an up-front payment of GBP2.625m, a deferred payment of

GBP2.625m and an earn out provision, capped at GBP5.25m, which will

operate over five years and is subject to a minimum, itself

dependent upon certain conditions. In addition, the parties have

agreed to work together to support the launch, on the Rize

platform, of a number of ETF products for the River and Mercantile

business, AssetCo's active equity asset management subsidiary.

The sale agreement accelerates the delivery of the potential of

this fundamentally attractive business. Rize will become the hub

for ARK's expansion into Europe and AssetCo is delighted to be

aligned with ARK's and Rize's future success, both through the

mechanism of the earn out agreement and the on-going ETF

partnership. It also simplifies the AssetCo business model which

will in turn reduce costs and improve profits.

As at 31 August 2023, Rize managed $452m in assets in 11 ETFs,

all categorised as SFDR Article 8 or 9 compliant, domiciled in

Dublin and distributed throughout Europe. ARK manages $25bn in ETFs

and other products globally.

For the year ended 30 September 2022, Rize made a loss before

tax of GBP2.5m on revenues of GBP1.9m, and as at 31 March 2023

gross assets were GBP0.75m. Completion of the deal is with

immediate effect (Rize is not, itself, directly regulated), so that

ARK takes immediate economic responsibility for the Rize

business.

The value of goodwill attributed to Rize by AssetCo was GBP12m

as at 31 March 2023 and AssetCo has decided to write that value

down to GBP5m, before accounting for sale proceeds. Against this,

the earn out from the sale agreement (capped at GBP5.25m) will

emerge as a positive cash flow in future years.

Parmenion Capital Partners LLP ("Parmenion")

AssetCo is aware of the speculation around the value of its 30%

equity interest in Parmenion that it acquired for an initial

consideration of GBP20.6m in October 2021. Since acquiring the

interest Parmenion has traded strongly in terms of AUM, revenue and

profitability. Parmenion's shareholders have also received a number

of approaches for the company.

As a result, AssetCo instructed an independent valuation of its

equity interest in Parmenion that concluded that AssetCo's equity

interest had a current value of between GBP75-90m. There are

currently 141,009,943 AssetCo shares in the market which therefore

equates to a value of between 53.2p and 63.8p per share for

Parmenion alone.

Martin Gilbert, Executive Chair of AssetCo said:

"We have consistently said that we see enormous potential for

the development of the ETF market in Europe and we continue to

believe that Rize is well placed to be a key participant in that.

We have come to the view that the best way for Rize to achieve that

ambition is to partner with an established global player to do so.

We are therefore delighted to have reached agreement with ARK

Invest LLP to establish Rize as their hub for expansion into

Europe. ARK are a committed and highly successful ETF player based

in the US and we are extremely pleased to have reached an agreement

that maintains our interest in the growth of their business for a

period and also to partner with them to launch our own ETF products

(managed by River and Mercantile Asset Management).

I am also pleased to share the results of an independent

valuation of our interest in Parmenion which has been the result of

some speculation in the market. The valuation confirms the

considerable value of our stake and the strength of the Parmenion

business."

Cathie D. Wood, Founder, CIO and CEO of ARK Invest added:

"Today's acquisition advances ARK Invest's commitment to offer

high-quality thematic investment solutions to a global investor

audience, particularly European investors who have not been able to

access our products. We believe that the European ETF market

presents a strong growth opportunity as new and younger investors

continue to gain access to ETFs via the growth of digital

platforms, and as active ETFs increase market share by meeting the

demand for innovative investment exposures. We are delighted to

welcome the talented Rize ETF team into the ARK family and to

partner with AssetCo as part of this transaction . By merging the

Rize Team's passion for thematic and sustainable index investing

with ARK's innovative actively managed approach centered on

disruptive innovation, we can offer our clients a more diverse

array of investment options to invest in the future. Together, we

will continue to educate and empower investors, helping them to

achieve their long-term financial goals."

About ARK Invest LLC

ARK Invest LLC controls ARK Investment Management LLC which is a

federally registered investment adviser and privately held

investment firm. Specializing in thematic investing in disruptive

innovation, the firm is rooted in over 40 years of experience in

identifying and investing in innovations that should change the way

the world works. Through its open research process, ARK identifies

companies that it believes are leading and benefiting from

cross-sector innovations such as robotics, energy storage,

multiomic sequencing, artificial intelligence, and blockchain

technology. ARK's investment strategies include Autonomous

Technology and Robotics, Next Generation Internet, Genomic

Revolution, Fintech Innovation, Space Exploration & Innovation,

3D Printing, Israel Innovative Technology, Venture Capital, and the

overall ARK Disruptive Innovation Strategy. For more information

about ARK, its offerings, and original research, please visit

www.ark-invest.com.

For further information, please

contact:

AssetCo plc Numis Securities Limited

Gary Marshall, CFOO Nominated adviser and joint broker

Peter McKellar, Deputy Chairman Giles Rolls / Charles Farquhar

Tel: +44 (0) 7788 338157 Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/Advisors Maitland

Joint broker Neil Bennett

Atholl Tweedie Rachel Cohen

Tel: +44 (0) 20 7886 2906 Tel: +44 (0) 20 7379 55151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUROARONUKURR

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

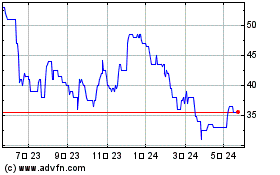

Assetco (LSE:ASTO)

過去 株価チャート

から 10 2024 まで 12 2024

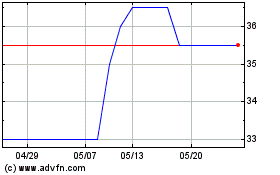

Assetco (LSE:ASTO)

過去 株価チャート

から 12 2023 まで 12 2024