Chainlink Gives “Golden” Signal After Nearly 300 Days Of Consolidation

2023年2月28日 - 6:16AM

NEWSBTC

Chainlink (LINK) daily charts have triggered a golden cross, adding

to the growing number of cryptocurrencies that have given such a

signal. But unlike other coins, LINKUSD has been in tight

consolidation for nearly 300 days. Here’s more on why that number

and supporting technicals makes the daily golden cross that much

more significant. LINKUSD Triggers Daily Golden Cross: What It

Means A golden cross in cryptocurrencies, stocks, forex, or other

financial market, is a buy signal that suggests that the trend

could be turning increasingly bullish. The buy signal and “golden

cross” takes place when a short-term moving average crosses above a

long-term moving average from below. The opposite signal, when the

short-term crosses below the long-term moving average from above,

is called the death cross. Related Reading: Total Crypto Market

Triggers Golden Cross, Despite “Deadly” Bitcoin Counterpart When

LINKUSD last death crossed on the daily Chainlink was trading at

above $20 per coin. In fact, two death crosses took place around

this level, along with a failed golden cross. The failed golden

cross could leave crypto investors and traders feeling skeptical

and not wanting to get caught in a fakeout yet again. However, the

latest Chainlink golden cross is coming after a nearly 300-day

consolidation phase. Chainlink LINKUSD 1D has golden crossed |

LINKUSD on TradingView.com Why 300-Day Consolidation Could Mean A

Huge Move In Chainlink Consolidation comes either at a top or a

bottom before a reversal, or mid-trend ahead of continuation. The

longer the time spent in a trading range, the larger the breakout

from the range. LINKUSD has been in a trading range for nearly 300

days and counting, suggesting a massive move ahead. The low

volatility phase has led to the tightest weekly Bollinger Bands in

the history of Chainlink. Chainlink LINKUSD 1W Bollinger Bands are

crazy tight | LINKUSD on TradingView.com The extreme low volatility

state has persisted for more than half of the consolidation phase,

adding to the potential power of a breakout and expansion of the

Bollinger Bands. Simply put, when volatility returns, Chainlink

could take off like a rocket, or fall off a cliff – depending on

the direction of the breakout. A golden cross on the daily

timeframe at such substantial lows could add to the probability of

the direction being up. Related Reading: This “Super” Buy Signal

Suggests The Crypto Bull Trend Is Strengthening A large move to the

upside in Chainlink could signal that its bear market low is in and

lead to a more significant and sustained recovery – especially if

the token is joined by broader participation from the rest of the

cryptocurrency market. Follow @TonyTheBullBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

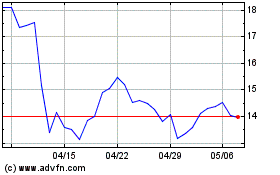

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 3 2024 まで 4 2024

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 4 2023 まで 4 2024