TIDMOCI

RNS Number : 8619I

Oakley Capital Investments Limited

10 August 2023

10 August 2023

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Fund V(2) ("Fund V") has, subject to

regulatory approval, agreed to acquire Flemming Dental, Excent, and

Artinorway Group (combined as "the Company") in a carve-out from

European Dental Group ("EDG"), a leading pan-European oral care and

services provider, to form one of the leading dental laboratories

groups in Europe.

OCI's indirect contribution via Fund V is expected to be c.GBP35

million.

Note that the above figure only relates to OCI's share of

Oakley's overall investment in Flemming Dental, Excent, and

Artinorway Group.

Further details on the transaction can be found in the below

announcement from Oakley Capital(3.)

Oakley Capital invests in Flemming Dental, Excent and Artinorway

Group

Oakley Capital ("Oakley"), a leading pan-European private equity

investor, is pleased to announce that Oakley Capital Fund V ("Fund

V") has agreed to acquire Flemming Dental, Excent, and Artinorway

Group (combined as the "Company") in a carve-out from European

Dental Group ("EDG"), a leading pan-European oral care and services

provider, to form one of the leading dental laboratories groups in

Europe.

The Company provides a comprehensive range of services,

including the design and manufacture of dental prostheses (crowns,

bridges and dentures) and orthodontics (braces, retainers and

aligners), utilising technology including CAD software,

computer-aided milling and 3D printing, as well as local

craftmanship. The Company currently services c.5,000 clinics across

nearly 70 dental laboratories throughout Europe.

Oakley will work closely with the management to establish

Flemming Dental, Excent and Artinorway Group as an independent

business and to become a leader in the global dental lab market.

Through this transaction, Oakley is leveraging its network of

entrepreneurs, partnering with Hidde Hoeve, the co-founder of

Excent Tandtechniek, a group of dental laboratories acquired by EDG

in 2018. The collaboration between Oakley and the Company's

experienced management team will see the execution of an ambitious

growth strategy, driven by organic growth, international expansion

and targeted M&A.

Through Fund V's investment, the Company will benefit from

Oakley's extensive expertise in digitalisation, helping the Company

to capitalise on technological innovation in the dental lab

industry and the rapid digital transformation of the market. Fund

V's investment will enable the Company to accelerate innovation and

the adoption of cutting-edge technology, providing solutions with

unparalleled precision for dental clinics and their patients across

Europe and beyond. The European dental lab market is large and

growing with strong customer stickiness, valued at approximately

EUR10 billion today, and is also highly fragmented offering

compelling opportunities for value creation through buy-and-build,

which is an area Oakley has extensive expertise in.

The transaction is subject to regulatory approval.

Oakley Capital Managing Partner and co-Founder Peter Dubens

commented:

"This is a key inflection point for the dental laboratory

industry, with rapid digitalisation poised to revolutionise dental

design and manufacturing, and patient care. We look forward to

working closely with Hidde Hoeve and the management team as we

establish Flemming Dental, Excent and Artinorway Group as an

independent company and leverage transformational new technologies

to unlock its full potential for future growth."

Excent co-founder and CEO of the new combined entity Hidde Hoeve

commented:

"In Oakley we have the ideal partner to support Flemming Dental,

Excent and Artinorway Group as they begin the next chapter as an

independent business. We are well positioned to capitalise on the

accelerating digitalisation of dental laboratories. Together with

the current management, we will maintain focus on our clients,

local craftsmanship and innovation. Oakley's expertise will be

invaluable as we execute our growth strategy to become the leader

in the global dental lab market."

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds (2) .

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund and are unlisted lower-mid to mid-market private equity funds

that aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement. The Oakley family of

funds also includes Oakley PROfounders Fund III and Oakley Touring

Venture Fund, which are venture capital funds focused on

investments in entrepreneur-led, disruptive, technology led

companies.

For more information on the Oakley Fund strategies in which OCI

invests, please click here.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQKKLFBXVLZBBQ

(END) Dow Jones Newswires

August 10, 2023 02:00 ET (06:00 GMT)

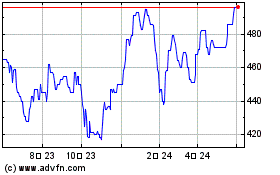

Oakley Capital Investments (AQSE:OCI.GB)

過去 株価チャート

から 11 2024 まで 12 2024

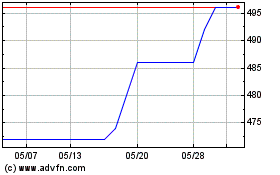

Oakley Capital Investments (AQSE:OCI.GB)

過去 株価チャート

から 12 2023 まで 12 2024