Oil Pulls Back From Recent Rally Despite Iraq Tensions

2017年10月20日 - 7:48PM

Dow Jones News

By Christopher Alessi

LONDON -- Oil prices fell for a second consecutive day Friday,

coming off a three-week high earlier in the week, as investors

considered the potential impact of ongoing geopolitical risks on

global oil supply.

Brent crude, the global benchmark, fell nearly 1%, to $56.67 a

barrel on London's Intercontinental Exchange. On the New York

Mercantile Exchange, West Texas Intermediate futures were trading

down 1.15% at $50.70 a barrel.

"We've seen a fairly decent rally, but we are probably starting

to see the top end of the range," said Michael Hewson, chief market

analyst at brokerage CMC Markets UK PLC.

While oil prices are close to their highest levels seen this

year, investors are concerned that pushing prices too high could

spur U.S. crude producers to ramp up shale production, Mr. Hewson

said. That could exacerbate the global supply glut and undermine

the fragile market rebalancing underway, analysts say.

Crude prices climbed earlier in the week after clashes between

Iraqi government troops and forces from the semi-autonomous Kurdish

region disrupted some oil production and exports. Kurds voted

nearly unanimously to break away from Iraq in a controversial

independence referendum late last month.

Oil supplies that flow from Kurdistan, in northern Iraq, through

Turkey fell to around 196,000 barrels a day on Thursday, compared

with a usual supply of around 600,000 barrels a day, according to

Dutch bank ING Group.

"A prolonged disruption to this supply could tighten the oil

market in Europe," analysts at ING said.

Meanwhile, the head of the Organization of the Petroleum

Exporting Countries said Thursday that there is "no doubt the oil

market is rebalancing at an accelerated pace." Speaking to a

gathering of oil industry executives and experts in London, OPEC

Secretary General Mohammed Barkindo insisted that cartel's plan to

cut output and rein in the global supply glut was paying off.

However, "not even a slew of supportive comments from OPEC's

secretary general succeeded in injecting a dose of bullish

impetus," Stephen Brenonck, an analyst at brokerage PVM Oil

Associates Ltd., wrote in a note Friday.

OPEC and 10 producers outside the cartel, including Russia,

first agreed late last year to cap their production at around 1.8

million barrels a day lower than peak October 2016 levels, with the

aim of alleviating global oversupply and boosting prices.

The deal was extended in May through March 2018 and a number of

participants have in recent weeks indicated a willingness to

prolong the deal through the end of next year. OPEC is set to

officially debate an extension at its next meeting in Vienna in

November.

Among refined products, Nymex reformulated gasoline blendstock

-- the benchmark gasoline contract -- was down 0.90%, at $1.60 a

gallon. ICE gasoil, a benchmark for diesel fuel, changed hands at

$517.00 a metric ton, down 1.19% from the previous settlement.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

October 20, 2017 06:33 ET (10:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

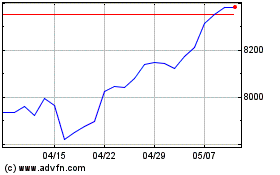

FTSE 100

指数チャート

から 3 2024 まで 4 2024

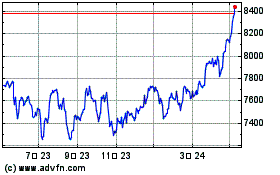

FTSE 100

指数チャート

から 4 2023 まで 4 2024