EUROPE MARKETS: European Stock Gains Limited As Auto, Mining Shares Fall

2017年5月25日 - 12:09AM

Dow Jones News

By Carla Mozee, MarketWatch

So far, 'limited' effects from negative rates, says ECB's

Draghi

Most major European markets ebbed lower Wednesday, with

automobile makers Daimler AG and Fiat Chrysler Automobiles and

mining stocks among those struggling, but stayed in the red after

European Central Bank President Mario Draghi maintained his dovish

tone.

Among benchmarks, Germany's DAX was off 0.2% at 12,636.89 and

Italy's FTSE MIB declined 0.3% to 21,350.88.

But the Stoxx Europe 600 clung to a gain of less than 1 point at

392.21, as most most U.K. blue-chips rose, lifting the FTSE 100 up

0.3% to 7,510.66

(http://www.marketwatch.com/story/mining-retail-shares-tug-ftse-100-slightly-into-the-red-2017-05-24).

On a sector basis in Europe, utility, basic material and

consumer goods shares were in the red, but health care, technology

and telecom stocks were among those advancing.

China cut: Investors entered Wednesday's session with a

downgrade of China's credit rating at Moody's for the first time in

nearly 30 years

(http://www.marketwatch.com/story/moodys-downgrades-china-rating-for-the-first-time-in-nearly-30-years-2017-05-24),

to A1 from Aa3. Moody's cited concerns about the impact that rising

levels of debt will have on the world's second-largest economy,

which is a major buyer of industrial and precious metals.

Mining shares were lower, with Fresnillo PLC (FRES.LN) down 1.8%

and iron ore heavyweight Rio Tinto PLC (RIO) (RIO) (RIO) off 1.6%.

Boliden AB (BOL.SK) was losing 0.7% and Norwegian aluminum company

Norsk Hydro ASA (NHYDY) gave up 1.3%.

Investors have already been aware of China's credit-expansion

issue, said Mark Williams, chief China economist at Capital

Economics, in note.

"The greater concern, in our view, is not what the debt build-up

is doing to government creditworthiness. Instead, it is that loose

credit policies designed to prevent struggling firms from failing

are eroding the economy's long-run growth potential by preventing

resources from being allocated to areas where they could be used

more efficiently," he wrote.

Central banks: There's been "an increasingly solid recovery" in

the eurozone economy although underlying inflation pressures are

still subdued, said Draghi at a speech in Madrid at Banco de

España. Eurozone PMIs released Tuesday showed economic activity has

remained at a six-year high.

But Draghi also said he doesn't see it necessary to change

course on its policy direction, which includes an overnight deposit

rate set at negative 0.4%. The ECB has said it could increase the

size or lengthen the duration of its asset-buying program if

inflation looks set to fall far back below its target of near but

just below 2%.

"[I]n in a multi-country monetary union such as the euro area,

made up of segmented national financial markets, asset purchases

are inevitably more difficult to calibrate, more complex to

implement, and more likely to produce side effects than other

instruments, including moderately negative rates," Draghi said.

"Negative rates may also have unwarranted side effects, but those

have so far remained limited."

After Draghi's speech, the euro was buying $1.1195, up from

$1.1184 late Tuesday in New York. The currency pair will be in

focus when the Federal Reserve releases the minutes from its most

recent meeting at 7 p.m. London time, or 2 p.m. Eastern Time.

Investors have largely priced in a rate hike by the Fed at its

June 13-14 meeting, so markets will watch for any language that

suggests policy makers may hold off on the anticipated move.

Read:Fed minutes may quell doubt about a June interest-rate hike

(http://www.marketwatch.com/story/fed-minutes-may-quell-fresh-doubts-about-a-june-rate-hike-2017-05-19)

Stock movers: Daimler AG (DAI.XE) fell 2.1%, leading decliners

on the DAX, after German authorities raided the company's Stuttgart

headquarters

(http://www.marketwatch.com/story/daimler-offices-raided-in-diesel-emissions-probe-2017-05-23)and

other sites to secure evidence in their investigation in possible

diesel-emissions fraud by the car maker. Prosecutors said on

Tuesday the offices were raided.

Fiat Chrysler Automobiles NV (FCA.MI) (FCA.MI) fell 1.1%, with

the car maker late Tuesday saying it was "disappointed" the U.S.

Justice Department filed a complaint

(http://www.marketwatch.com/story/fiat-chrysler-chafes-against-claims-of-diesel-emissions-cheat-shares-fall-2017-05-23)

against the company related to allegations it used software to

cheat diesel-emission tests.

Kingfisher PLC shares (KGF.LN) fell 7.1% after the parent of

home-improvement stores B&Q and Castorama said first-quarter

comparable sales fell 0.6%

(http://www.marketwatch.com/story/kingfisher-quarterly-same-store-sales-decline-2017-05-24)

on weak sales in France and disruption caused by a company

overhaul.

Shares of French aerospace supplier Safran SA (SAF.FR) and

Zodiac Aerospace (ZC.FR) each remained halted after Safran said it

cut its bid price

(http://www.marketwatch.com/story/safran-cuts-offer-for-zodiac-aerospace-by-15-2017-05-24)

for the plane cabin-interior specialist following Zodiac's profit

warning.

(END) Dow Jones Newswires

May 24, 2017 10:54 ET (14:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

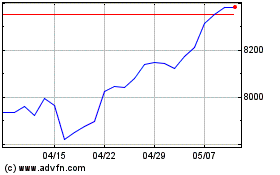

FTSE 100

指数チャート

から 3 2024 まで 4 2024

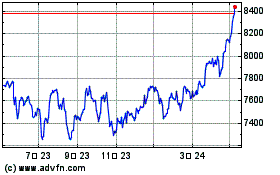

FTSE 100

指数チャート

から 4 2023 まで 4 2024